Welcome back,

The choppy waters of global public markets are something to behold. Grab’s currently market cap, for example, is lower than the total amount of funding it has raised. That’s caused some firms to be cautious—Indonesian digital lender Kredivo has canceled its planned SPAC—but still Gojek and Tokopedia planned IPO, a major coming-out event for Indonesia’s tech community, will go ahead at a planned valuation of nearly $30B. It seems insane. Can it work? Is there a plan? We will find out in early April.

Elsewhere, China’s Tencent is looking like it’ll be on the sharp end of government regulation; a major merger is happening in India; China has a Japan-inspired hit game; and much, much more.

If you find yourself looking for more regular Southeast Asia newsletters, check out our friends at Backscoop, who send out three newsletters a week that recap the latest developments.

You can also follow the ATR Telegram channel, which is absolutely free and here: https://t.me/asiatechbulletin

That’s all for this edition—see you next time,

Jon

In focus: the 5 biggest stories of the week

The plan, which bears similarities to the restructuring of Ant Financial following its scrapped IPO, could force WeChat to obtain a new licence and force Tencent to fold its banking, securities, insurance and credit-scoring services into a financial holding company that can be regulated like a traditional bank. It's unclear whether WeChat will be included in that spinoff since it straddles financial services, including payment, and social services. Tencent is facing fines for flouting money laundering rules with WeChat

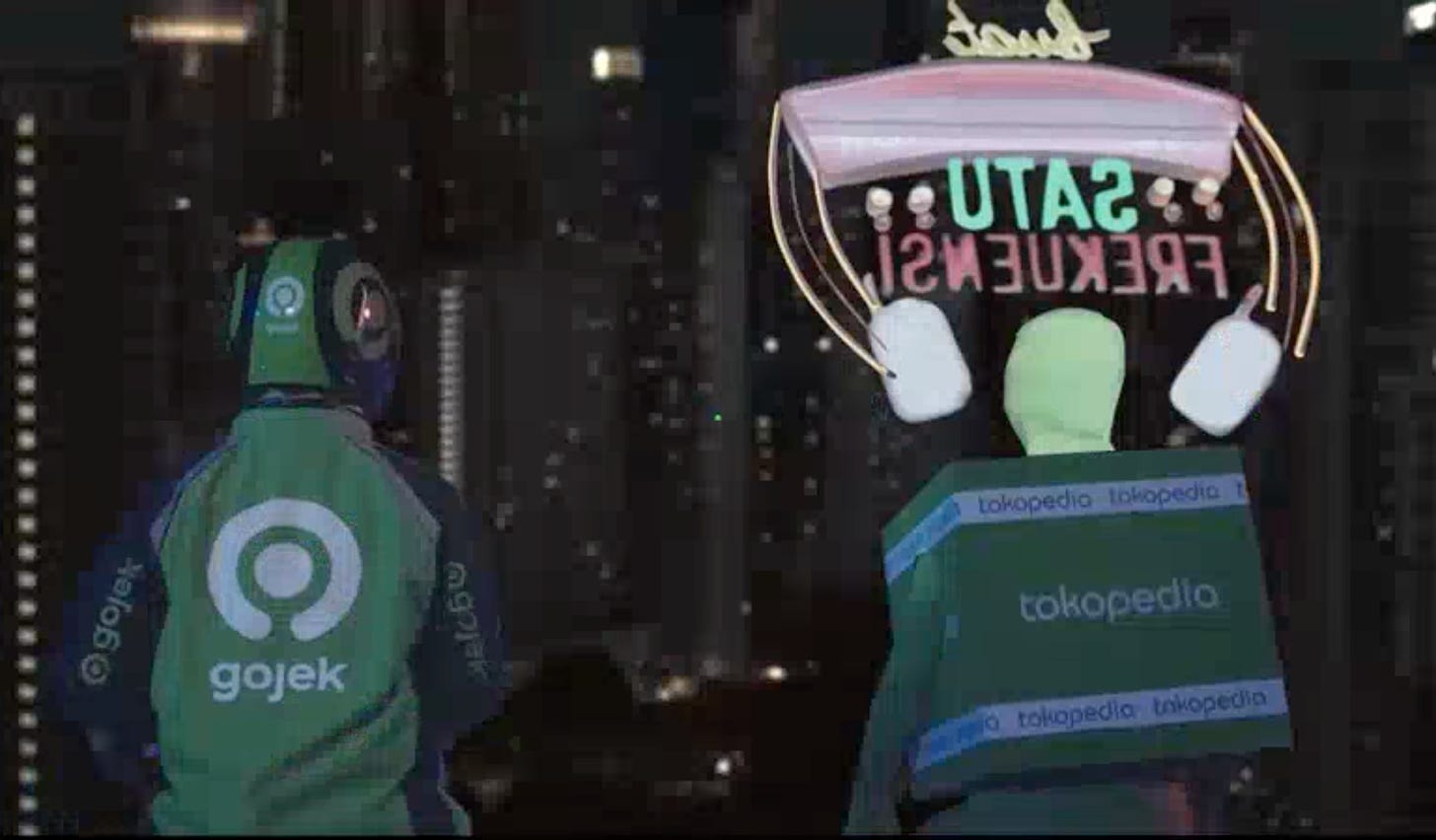

GoTo seeks Indonesia IPO valuing firm at up to $28.8 Billion

Despite the currently treacherous public market waters, GoTo—the merged entity of Gojek and Tokopedia—plans to raise $1.25B from its planned Indonesia-based IPO. It's controversial since Grab’s own valuation plummeted to less than $12B this past week, encouraging suggestions that GoTo’s valuation may be unrealistic, or at least unsustainable. Counterpoints focus around potential GoTo synergies and the fact that the group’s stake in Indonesia’s Bank Jago is alone worth billions—we shall see on April 4 when the IPO is slated.

Zomato and Blinkit reach agreement for merger

It’s been some time since Uber left India’s food delivery space, and there’s now further consolidation. Zomato and instant delivery service Blinkit have reached an agreement for a merger, a source familiar with the matter told TechCrunch. The all-stock deal reportedly values Blinkit between $700 million and $750 million.

Amagi enters India's unicorn club with $95 million funding from Accel, others

The cloud SaaS technology provider for broadcast and streaming television raised $95M led by Accel. Existing backers Norwest Venture Partners and Avataar Ventures were part of the round which brings the company's total financing to more than $245M.

Genshin Impact, a smash hit from China, beats Japan at its own game

Genshin Impact, a game that I’ve noticed my kids playing extensively, is finally getting some recognition in the press. Described as a nearly picture-perfect reproduction of Japanese fantasy role-playing games, it has raked in billions of dollars and sent shock waves through the world’s aging video game superpower, showing that Chinese studios can learn and iterate on Japan’s work. I’m still blown away just how much like a Legend of Zelda game Genshin, perhaps another important point is Nintendo’s failure to put its IP to work on third-party platforms which leaves a spot open for imitators.

China

The world may be moving past Covid, but issues with China’s no-Covid policy will cause problems. This week, Foxconn suspended iPhone factories in Shenzhen following a lockdown link

Elsewhere, Foxconn is in talks with Saudi Arabia about jointly building a $9B multipurpose facility that could make microchips, electric-vehicle components and other electronics like displays link

China’s cyberspace watchdog unveiled new draft rules to make it harder for big tech firms to profit from video gaming, live streaming and social media services targeted at the country’s 180 million internet users under the age of 18 link

But there may be hope: China’s regulatory storm may soon subside for Big Tech firms after Xi Jinping’s right-hand man calls for order and transparency link

Still, though, the immediate effects mean Alibaba and Tencent are reportedly preparing to cut tens of thousands of jobs combined this year in one of their biggest layoff rounds as the internet firms try to cope with China's sweeping regulatory crackdown link

Two of Apple's most important Chinese product assemblers (Luxshare and Goertek) are venturing into chip packaging as Beijing continues to set its sights on creating a fully-fledged domestic semiconductor industry link

Foxconn reported a net profit of T$44.4 billion ($1.55 billion) for October-December, above estimates but down 3.4% compared with the year ago period link

Surveillance camera maker Hikvision plans to buy a second-hand lithography machine made by Dutch firm ASML Holding for its in-house chip manufacturing operation for $5.5B, according to a report—the deal would be a big move towards tech self-sufficiency amid US trade restrictions and a global semiconductor shortage link

Autonomous trucking startup TuSimple, which went public on Nasdaq last year, is looking to sell its business in China and focus on the US market due to “tighter regulations” in the two countries link

DJI has found itself in a tricky spot with both the Ukraine and Russia using its drones in their war—the US and China also use the tech which the firm has said isn’t designed for military operations link

JD Logistics is buying rival Deppon for $1.4 billion link

Aibee, a Chinese artificial intelligence startup, is getting fresh funding from Xiaomi, which propels its valuation to more than $1 billion link

DeepGlint, an AI firm that once shot for a $300B valuation, had a lowkey trading debut in Shanghai after a share decline saw its market capitalisation reach $1B—the company was added to the US government’s trade blacklist last year link

Hong Kong

SCMP CEO Gary Liu, a former boss of Reddit, has moved on to lead an NFT spinoff leaving Alibaba to hunt for a new chief for the newspaper link

Digital wallet usage is tipped to overtake credits card in Hong Kong by 2025 and reach 40% of online transactions link

India

Byju Raveendran financed his latest $400M investment in Byju’s through debt raised from multiple international banks in shades of OYO founder Ritesh Agarwal who took a $2B loan in 2019 for an investment—Byju’s has been strongly linked with an IPO that could value it at more than $22B link

Speaking of OYO, it is reportedly planning to reduce its planned $1B IPO raise and could reduce its valuation from $12B to $6B link

Seven months after it was launched in India, Apple is expected to start manufacturing the iPhone 13 at the Foxconn plant in Sriperumbudur near Chennai from April, according to sources—the phones will be for both the domestic and export market link

Employee engagement platform inFeedo raised $12M led by Jungle Ventures, with participation from Tiger Global and existing investors like Bling Capital—it previously raised $4M link

India’s Licious raises $150M for its fresh animal protein e-commerce platform—that takes Licious to $488M raised to date link

Amazon and Future ceasefire talks have failed, lawyers told India's Supreme Court link — Amazon reportedly demanded Future return at least $200M of its investment from 2019—Future instead offered a stake of an equivalent amount in one of its remaining group companies after Reliance takes over most of its retail assets link

Snap didn’t used to bother much in India but now its localisation strategy for the country, where it now has over 100M monthly users, will become the playbook for localising in other countries, CEO Evan Spiegel has said link

Multiplier, a startup that enables companies to hire and pay remote workers while complying with local laws, raises $60M led by Tiger Global and Sequoia India—its now valued around $400M link

Footballer Cristiano Ronaldo is said to be among the investors poised to pump $100M into FanCraze, an online platform for trading licensed cricket NFTs in the style of football service Sorare link

Brand aggregator and roll-up commerce company UpScalio raised a $15M bridge round led by Gulf Islamic Investments link

A security lapse caused internal documents, health records and personnel files belonging to India’s Central Industrial Security Force to be available to anyone online right from their browser link

Paytm has refuted a report that it shared data with Chinese firms link

Mega conglomerate Tata plans to launch its own digital payments app to tap the national UPI payment system link

Southeast Asia

It’s a tough market out there—ask Grab or Sea—and so perhaps it’s not a huge surprise to see lending platform Kredivo scrap its planned $2.5B US SPAC deal. Instead, lead investor Victory Park Capital will lead a $145M private investment round in the company. The proceeds of the SPAC were designed to help the buy now, pay later company expand across Southeast Asia having seen demand in Indonesia rocket during the pandemic link

Here’s a detailed take from The Ken—it’s a free-to-read story

You don’t often hear from Forrest Li, who prefers secrecy and doing business to shouting about it, but he released a 900-word memo to address a share decline that’s wiped $150B from his firm’s valuation since late 2021. The word from the top is essentially “keep calm and carry on,” with Li arguing Sea has a long-term plan link

Earned wage platforms are all the rage in Southeast Asia this year and Wagely raised $8.3M and expanded into Bangladesh link

Japan

Block, the payment firm formerly known as Square, backed Japanese fintech startup Kyash in latest $41.2M round—Kyash has now raised over $107M link

Korea

Kakao Group founder Brian Kim stepped down from the board after a series of scandals rocked the South Korean social media and fintech giant link

Rest of Asia

How crypto mining went from boom to bust in Kazakhstan link

Africa-based mobility platform Moove raised $105M to bring its vehicle financing to Asia, Europe and MENA link

Airlift Mafia: Pakistan’s buzziest startup has created a new class of founders link

Bazaar raised $70M from Tiger Global and Dragoneer to digitize Pakistan’s retail link

Binance has been given a crypto-asset service provider licence by Bahrain's central bank, its first such licence in the Gulf Cooperation Council link

SoftBank founder Masayoshi Son lost $25B in tech’s “brutal winter” link

You just finished reading Asia Tech Review, the weekly newsletter for keeping up with the tech industry across Asia.

If someone sent this to you, you can sign up for free at Asiatechreview.com

I have exciting news to share: You can now read Asia Tech Review in the new Substack app for iPhone.

With the app, you’ll have a dedicated Inbox for my Substack and any others you subscribe to. New posts will never get lost in your email filters, or stuck in spam. Longer posts will never cut-off by your email app. Comments and rich media will all work seamlessly. Overall, it’s a big upgrade to the reading experience.

The Substack app is currently available for iOS. If you don’t have an Apple device, you can join the Android waitlist here.